Content

However, it would be best if you had diligence, attention to detail, and a logical mind to decipher why the change happens. The method also enables the analysis of relative changes in different product lines and projections into the future. Pick a base year, and compare the dollar and percent change to subsequent years with the base year. Horizontal analysis shows a company’s growth and financial position versus competitors. We accept payments via credit card, wire transfer, Western Union, and bank loan.

- On the other hand, comparability constraint dictates that a company’s financial statements and other documentation be such that they can be evaluated against other similar companies within the same industry.

- Let us now look at the horizontal analysis of Colgate’s income statement.

- Google is in a good phase of business at the moment, and will likely continue to expand and announce new products and tech as they normally do.

- Ratios such as earnings per share, return on assets, and return on equity are similarly invaluable.

- So, when comparing account balances between different periods, there are likely to be variances.

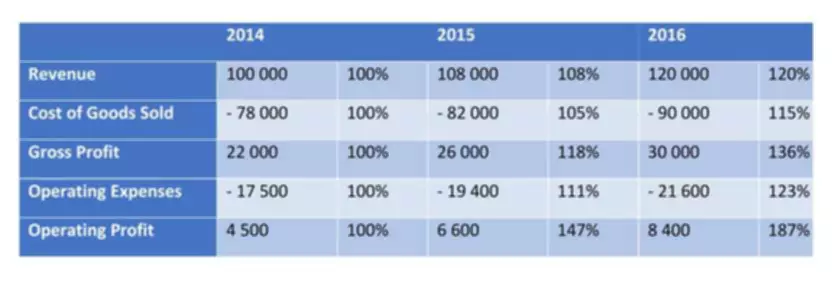

Horizontal analysis is the comparison of financial data from one accounting period, usually a recent year, to a base accounting period, usually a prior year, and identifies trends. It can be performed on any financial data that has been recorded over time. To perform a horizontal analysis, first it is necessary to calculate the dollar change from the base period to the target period, which can be as short as a month, or a quarter, or as long as a year.

Download a free copy of “Preparing Your AP Department For The Future”, to learn:

Better yet, you can see many years of balance sheets and income statements and make a comparison among them. For example, a horizontal analysis of the cost of insurance might list the cost on a quarterly basis for the past few years, while a vertical analysis would present it as a percentage of sales only for the current period.

- Different ratios, such as earnings per share or current ratio, are also compared for different accounting periods.

- A horizontal analysis of the trends in solvency ratios will reveal if the company is increasingly insolvent or stably solvent.

- Business owners can use company financial analysis both internally and externally.

- The dollar change is found by taking the dollar amount in the base year and subtracting that from the year of analysis.

- From the above calculation, we can see that the account payables, total current liabilities, common stock, total current assets, cash has increased in the year 2017 while long-term debt and net fixed assets has decreased.

Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. Please refer to the Payment & Financial Aid page for further information. By seeing the trend, which is a remarkable growth of over 100% from one year to the next, we can also see that the trend itself is not that remarkable of only 10% change from 2013 at 110% to 120% in 2014. Which could show, that perhaps growth is starting to stagnate or level-off. In a https://www.bookstime.com/, we state both the dollar amount of change and the percentage of change, because either one alone might be misleading.

How to Create a Horizontal Company Financial Statement Analysis

Consider enrolling in Financial Accounting or our other online finance and accounting courses, which can teach you the key financial topics you need to understand business performance and potential. Download our free course flowchart to determine which best aligns with your goals. While the definition of an income statement may remind you of a balance sheet, the two documents are designed for different uses. An income statement tallies income and expenses; a balance sheet, on the other hand, records assets, liabilities, and equity. A baseline is established because a financial analysis covering a span of many years may become cumbersome.

Trends in gross margin generally reveal how much pricing power a company has. We can even take this one step further by calculating the compound annual growth rate for each line item from 2014 to 2018. The analysis assumes that everything outside will more or less stay the same. This means that future projections don’t take into account possibilities like new technologies, changes in regulations, and/or new competitors disrupting the space. Again, it is important to look at the footnotes in the statement to determine if this is the case. Tammy teaches business courses at the post-secondary and secondary level and has a master’s of business administration in finance.

Financial Accounting

Horizontal analysis also makes it easier to compare growth rates and profitability among multiple companies in the same industry. Horizontal Analysis refers to the process of comparing the line of items over the period, in the comparative financial statement, to track the overall trend and performance. On the other hand, vertical analysis refers to the tool used to study financial statement by making a comparison of each line of the item as a proportion of the base figure within the statement, i.e. assets, liabilities, sales or equity. From the above calculation, we can see that the account payables, total current liabilities, common stock, total current assets, cash has increased in the year 2017 while long-term debt and net fixed assets has decreased. The significant increase in cash is due to the collection of account receivable, issue of common stock, sale of goods and fixed assets. However the company is not utilizing the cash to meet the current liabilities which is not good for the business.

It can also be used to project the amounts of various line items into the future. There’s a reason horizontal analysis is often referred to as trend analysis. Looking at and comparing the financial performance of your business from period to period can help you spot positive trends, such as an increase in sales, as well as red flags that need to be addressed. On the other hand, comparability constraint dictates that a company’s financial statements and other documentation be such that they can be evaluated against other similar companies within the same industry.

Key Differences Between Horizontal and Vertical Analysis

Financial Analysis is helpful in accurately ascertaining and forecasting future trends and conditions. The primary aim of horizontal analysis is to compare line items in order to ascertain the changes in trend over time. As against, the aim of vertical analysis is to ascertain the proportion of item, in relation to a common item in percentage terms. In Horizontal Financial Analysis, the comparison is made between an item of financial statement, with that of the base year’s corresponding item. On the other hand, in vertical financial analysis, an item of the financial statement is compared with the common item of the same accounting period. The Comparative Income Statement is drawn on the same principle as the Horizontal Balance Sheet. There are columns, as in a comparative balance sheet, to show the amount of income and expenditure for two years in or more along with the increase or decrease in amounts as also percentage increases or decreases.

This enables you to easily spot growth trends as well as any red flags that may need to be addressed. Learning how to read and understand an income statement can enable you to make more informed decisions about a company, whether it’s your own, your employer, or a potential investment. A total of $560 million in selling and operating expenses, and $293 million in general and administrative expenses, were subtracted from that profit, leaving an operating income of $765 million. To this, additional gains were added and losses were subtracted, including $257 million in income tax. It also compares a company’s performance from one period to another (current year vs. last year). Ratio Analysis – analyzes relationships between line items based on a company’s financial information. Business owners can use company financial analysis both internally and externally.

horizontal analysis can be manipulated to make the current period look better if specific historical periods of poor performance are chosen as a comparison. Note that the line-items are a condensed Balance Sheet and that the amounts are shown as dollar amounts and as percentages and the first year is established as a baseline. It depicts the amount of change as a percentage to show the difference over time as well as the dollar amount. When proportionate changes in the same figure over a given time period expressed as a percentage is known as horizontal analysis. The analysis of the different items in income statement is also done following the similar procedure. Determining the percentage change is important because it links the degree of change to the actual amounts involved. In this way, percentage changes are better for comparative purposes with other firms than are actual dollar changes.

That is done by looking at the annual or quarterly figures of the company and comparing it over a number of years. Now look at Columns and to see the vertical analysis that would be performed. Columns and express the dollar amount of each item in Columns and as a percentage of net sales. Even though cost of goods sold increased in 2010, it remained a fairly constant percentage of net sales. Therefore, gross profit as a percentage of net sales increased only slightly. The percentage of expenses to net sales decreased somewhat, thus yielding an increase in income before income taxes as a percentage of net sales.